Recent years have seen several innovations in the banking and finance sectors. The use of technology-based applications has revolutionized these sectors and touched the lives of millions of people. One such innovation is UPI or Universal Payment Interface. The use of UPI was recently extended to Singapore, extending the footprint of an Indian innovation to other countries. Here is how it all started:

The reach of traditional banking changed dramatically with the opening of 1.5 crore bank accounts on a single day (28 August 2014) in what was billed as the world’s largest-ever financial inclusion exercise called Pradhan Mantri Jan Dhan Yojana. The Guinness Book of World Records acknowledged it as a record, stating: “The most bank accounts opened in one week as a part of financial inclusion campaign is 18,096,130 and was achieved by banks in India from 23 to 29 August 2014″. In March 2020, the number of total bank accounts opened under this scheme stood at 38 crores. Of them, 29 crore account holders had a debit card (RuPay card) as well. The scheme was a combined result of using information technologies (linking mobile phones and Aadhar numbers) and accelerated implementation of the National Mission for Financial Inclusion which was launched for achieving universal banking.

For this scheme, six lakh villages in the country were grouped into 1.6 lakh sub-service areas with an area comprising 1000-1500 households. The Jan Dhan scheme was built upon the concept of Business Correspondents (BCs) – an innovation introduced in 2008 by the Reserve Bank of India as part of the financial inclusion programme. These individuals act as a bridge between a bank branch and account holders to solve the problem of last-mile connectivity in rural areas. Usually, these correspondents were retired bank or government officials and ex-servicemen residing in that particular area and were affiliated with a base branch of a bank. In the Jan Dhan scheme, they were deployed to provide access to banking services in about 1.3 lakh sub-service areas. The remaining 30,000 areas were covered through bank branches. The number of business correspondents of scheduled commercial banks in rural areas was 5.15 lakh in March 2018. They were also empowered to provide banking services using an interoperable Aadhar-enabled payment system. The accounts opened under the scheme are no-frills zero-balance accounts but come bundled with accident insurance cover of Rupees one lakh and an overdraft facility of INR 5,000. Government subsidies and other benefits such as pensions are supposed to be deposited directly in the bank accounts of the poor. The use of the ‘direct benefit transfer’ mode has helped in weeding out fake or duplicate beneficiaries and plugging leakages in dozens of welfare schemes.

Payment innovations

The financial inclusion drive was accompanied by innovative ways for financial transactions using mobile phones. The National Payments Corporation of India (NPCI) launched a novel payment system called the National Unified USSD Platform (NUUP) in November 2012. Also known as the ‘*99#’ service, it enabled users of feature phones to access banking services through dialling and text messaging. It does not require a smartphone or a mobile app for carrying out financial transactions. USSD (Unstructured Supplementary Service Data) technology is built for GSM phones for exchanging text.

For smartphones, NPCI in April 2016 came up with an app called Universal Payment Interface (UPI) that enabled immediate money transfer through mobile devices round the clock and merchant payments. It is a unique identification for a bank account that can be used for sending and receiving funds using a smartphone. All one needs to know is the receiver’s UPI ID for making a transaction, eliminating the need for knowing the bank account number or IFSC of the receiver. Most Indian banks support UPI and there are third-party UPI apps like PhonePe, Google Pay and Paytm. The government launched its own UPI app – BHIM or Bharat Interface for Money – to boost digital transactions after the demonetisation in November 2016. Since then, UPI has revolutionised the micropayment system in the country with millions of transactions being performed every day.

UPI was developed at NPCI in collaboration with the Reserve Bank of India and the Indian Banks Association. Technical help came from iSpirit – an industry platform to support software technology startups – in the form of Application Programming Interface or APIs (software that enables an app to create an interface with another app). A software engineer, Nikhil Kumar, who was volunteering for iSpirit, developed the BHIM app in December 2016, which became an instant success after demonetisation. As advisor (innovations and public policy) for NPCI, Nandan Nilekani catalysed the government agency’s interface with industry and entrepreneurs through iSpirit.

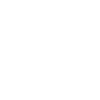

[Excerpted from ‘Indian Innovation, Not Jugaad: 100 ideas that transformed India’]

Below are some interviews the author had over the past year.